By ALEXANDRA DeMERITT

Contributing Writer

[email protected]

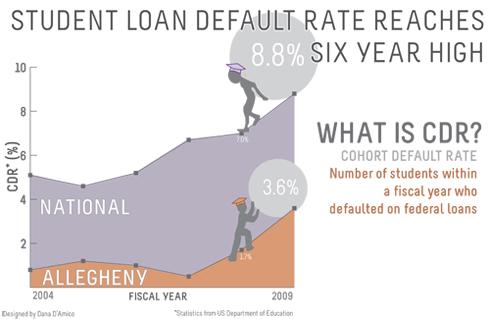

Allegheny’s federal loan default rate more than doubled between 2008 and 2009, although it remained well below the state and national rates.

At 8.8 percent, the United States collective default rate surpasses both Pennsylvania’s 6.5 percent and more than doubles Allegheny’s 3.6 percent.

Student loans have had a prominent role in current political activity as college graduates petition for loan forgiveness alongside Occupy Wall Street protesters.

President Barack Obama’s recent plan for slightly reduced college graduate interest rates comes at a time when the current subsidized Stafford loan rate is set to increase. The 2011-2012 temporarily reduced 3.4 percent rate will return to 6.8 percent in July.

“Allegheny College alumni have historically had very low cohort default rates,” said Sherry Proper, Director of Financial Aid.

The cohort default rate measures the number of students who began repaying federal loans in a fiscal year compared to the number to students who defaulted on loans.

Zachary Piso, ’11, reported that he had little trouble in paying off student loans. Piso entered the work force after graduation. He said he began paying off his loans as a student, using paid summer internships that he found through ACCEL.

“If you [intern] over two summers, that [can] give you a year’s worth of loans,” Piso said.

He also noted that his experience in loan-paybacks is not common.

“Most of the people I graduated with still have struggled… with their loans, with employment after leaving Allegheny,” said Piso.

Abby Bodenlos, ’08, also entered the work force immediately after graduation, a decision that she said helped her in managing college debt.

Her sister, Maggie Bodenlos, ’10, went to graduate school.

Maggie said she had to take some prerequisite courses at the University of Pittsburgh before she could enroll in graduate school. In order to do so, she had to take out additional loans on top of her Allegheny and graduate school loans.

Despite her accumulating debt, Maggie felt that loans can help students excel.

“[Loans] are definitely scary, but they’re there for us to succeed in the end,” Maggie said.

According to Proper, Allegheny students pay an average of $24,121 in loans.

Compared to the Project on Student Debt report, this is lower than the state average of $28,599.

Stephen Gerring, ’08, recently graduated from law school with more than $200,000 in debt, despite having had multiple scholarships. Gerring feels that student loans are comparable to credit card debt in that they have similar buy-now, pay-later mentalities.

“You’ve got these [18-year-old] kids signing up for these huge loans,” said Gerring. “You get shocked when you get your first bill, it’s huge.”

He has deferred payment on his loans until he finishes the Bar examination.